[ad_1]

I’m searching for the best dirt cheap FTSE 100 and FTSE 250 stocks to buy for my portfolio. The great news is that the UK’s leading stock indices are packed with brilliant bargains at the start of 2024.

Here are three I’m targeting for my Stocks and Shares ISA when I next have cash to invest.

Bank of Georgia Group

You can forget UK high street banks such as Lloyds, NatWest and Barclays. The prospect of sustained economic weakness in Britain means I’m searching further afield for banking stocks to buy.

Bank of Georgia Group (LSE:BGEO) is one stock on my radar today. Financial services demand is rocketing in the Eurasian country, reflecting a combination of low product penetration and strong economic growth. None of these qualities apply to the markets Lloyds et al operate in.

Cost pressures are a steady threat as the business invests in its digital platform. But so far the FTSE 250 firm is managing this problem well. Profits rose 32.4% between January and September as operating income also increased by around a third year on year.

I also like Bank of Georgia because of its excellent all-round value. It trades on a forward price-to-earnings (P/E) ratio of 4.5 times. Furthermore, it offers up a chunky 8.6% dividend yield for 2024.

Standard Chartered

Asia-focused Standard Chartered (LSE:STAN) is another top value stock on my radar. Like Bank of Georgia, it gives me exposure to fast-growing emerging markets where demand for banking products is tipped to surge.

Standard Chartered shares currently trade on a P/E ratio of just 5.3 times. They also carry a healthy 3.6% dividend yield for 2024.

Finally, the bank also carries a rock-bottom price-to-book (P/B) ratio. At 0.48, this is one of the lowest on the FTSE 100 today. And it suggests investors are massively undervaluing Standard Chartered shares relative to the value of its assets.

Created with TradingView.

Trading could remain turbulent here given tough trading conditions in its faraway markets. Underlying pre-tax profit dipped 2% in the third quarter of 2023 due to troubles in China’s property sector.

But I expect the bank to bounce back strongly over the long term. And the cheapness of its shares makes it a top stock to buy, in my view.

Rio Tinto

I already own Rio Tinto (LSE:RIO) shares in my portfolio. And I’m considering snapping up more to capitalise on the upcoming commodities supercycle.

Like the banks, Rio Tinto shares offer excellent all-round value. The company — which is the second-largest miner on the planet — trades on a forward P/E ratio of 9.2 times.

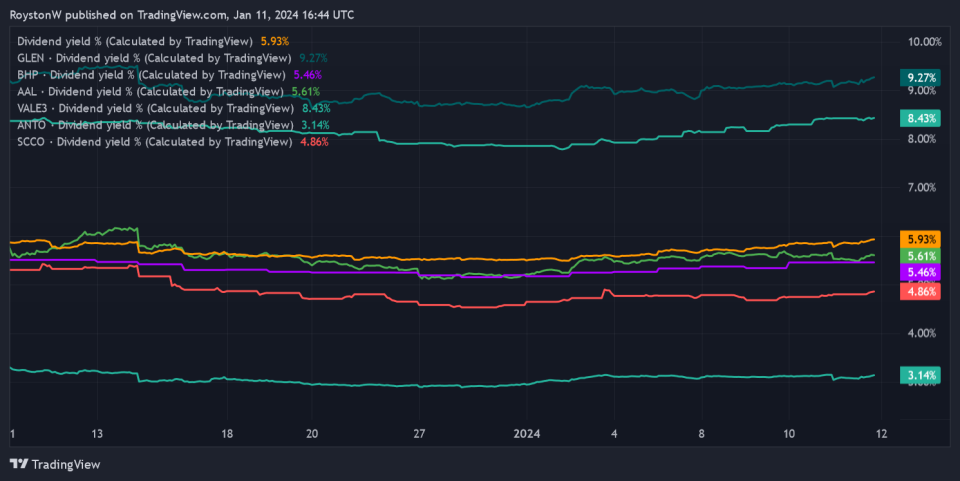

As the chart below shows, it offers one of the biggest forward dividend yields across the mining industry as well, at around 5.9%.

Created with TradingView. Also shows the forward dividend yields of Glencore, BHP, Anglo American, Vale, Antofagasta and Southern Copper.

Investing in mining stocks can be risky. This is because trouble at the exploration, mine development and production stages can be commonplace.

That said, Rio Tinto’s huge global portfolio of assets helps to reduce the impact of isolated trouble on group profits.

In fact, I’m expecting earnings here to rise strongly over the next decade. Themes like the energy transition and ongoing urbanisation should drive demand for industrial metals, lifting revenues through the roof.

The post 3 FTSE 100 and FTSE 250 value stocks I’d buy for my Stocks & Shares ISA! appeared first on The Motley Fool UK.

More reading

Royston Wild has positions in Rio Tinto Group. The Motley Fool UK has recommended Barclays Plc, Lloyds Banking Group Plc, and Standard Chartered Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

[ad_2]