[ad_1]

Bank of England staff are unhappy about their pay, according to a leaked survey – despite a 14pc jump in the number of staff on six-figure salaries last year.

Even though more than 500 people now earn over £100,000 a year at Threadneedle Street, workers still feel they are not earning a fair amount for the jobs they do.

The discontent comes after Andrew Bailey, the Bank’s Governor, urged the wider public not to ask for a big pay rise over fears it would stoke inflation.

When asked if “I am fairly compensated for the work that I do”, the survey – first leaked to Financial News – found an average satisfaction score of just 36pc.

The Bank’s staff earned an average of £62,189 in 2022-23, according to the institution’s latest annual report. This compares with just under £35,000 or the average full-time worker across the UK as a whole in 2023, according to the Office for National Statistics.

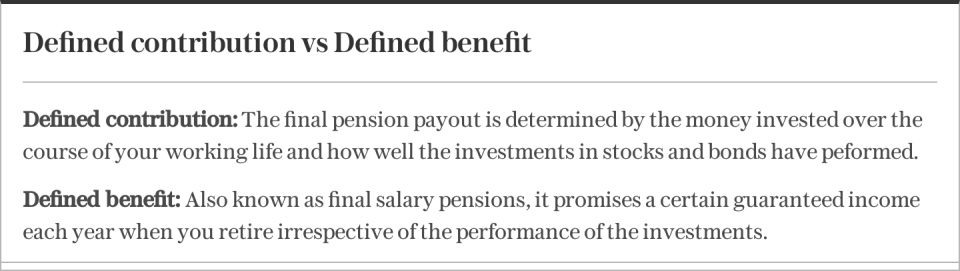

Employees at the Bank also enjoy one of the country’s most generous final salary pension schemes, guaranteeing them inflation-linked payments after retirement that are far more generous than anything available in the private sector.

The figures highlight the difficult position in which Mr Bailey finds himself, as staff want more pay but the Governor has repeatedly stressed the need for workers across the economy to rein in wage demands in the interests of keeping a lid on inflation.

In 2022 he said: “We do need to see a moderation of wage rises, now that’s painful. I don’t want to in any sense sugar that – it is painful. But we need to see that in order to get through this problem more quickly.”

Last year the Governor pointed the finger at prices charged by businesses as well as wage rises given to workers, which both needed to slow to get the cost of living back under control.

Speaking in August, he said: “It’s important, then, that price setting and wage setting reflects that because the current levels, I’ll be absolutely honest, are unsustainable. We cannot continue to have the current level of wage increases.”

So far inflation has slowed from its peak of 11.1pc in October 2022 to 4pc in December 2023. However, this is still double the Bank of England’s 2pc target.

For 2023-24, the Bank set a discretionary pay award budget of 3.5pc, which was focused on larger pay rises for staff on lower salaries, “reflecting that inflation affects the least well-off the most”.

Among the top brass, the four deputy governors and one chief operating officer received a pay rise of below 1pc between the financial years ending 2022 and 2023, with their salary and benefit totals coming in at between roughly £350,000 and £380,000.

The Governor did not take a raise, keeping his earnings and benefits at a total just short of £600,000, which the Bank’s annual report showed was eight-times median pay at the Bank.

On measures aside from pay, the survey showed Bank staff are less unhappy, with average satisfaction scores of above 60pc on measures including belonging, diversity commitment and work-life balance.

[ad_2]