[ad_1]

Barratt Developments is poised to buy Redrow after the housebuilders unveiled a surprise deal this morning.

The proposed move by Barratt values Redrow at £2.5 billion, representing a premium of 27% on last night’s closing price for the FTSE 250 company.

Elsewhere in the sector, it emerged that momentum in the house market has continued after Halifax reported a 1.3% rise in average prices last month.

FTSE 100 Live Wednesday

-

Barratt Developments in Redrow merger

-

Sainsbury’s eyes £1 billion in cost savings

-

House prices up in January

Greenpeace protesters scale Unilever headquarters in plastic pollution protest

13:06 , Daniel O’Boyle

Greenpeace protesters have scaled Unilever’s headquarters in London to protest against plastic pollution on the eve of the company’s 2023 profit announcement.

The campaign group hung a 13 metre-wide banner across an entrance to the building near Blackfriars Bridge on Wednesday morning, with the message: “Profit Warning: Plastic Polluted Money”.

Two protesters also sat atop walls of the building, waving black flags with a subverted version of Dove’s logo reading “Real Harm” – to raise awareness of the pollution they say is caused by the Unilever-owned beauty brand.

Soames shows the spirit needed to rescue the CBI

12:27 , Jonathan Prynn

Rupert Soames’s grandfather Winston Churchill had a phrase that neatly summed up his approach to leadership: Action This Day.

It epitomised the wartime prime minister’s determination to cut through inertia, negativity and bureaucracy to make the important things happen.

The new president of the CBI will need a lot of that if he is to save what was once Britain’s foremost business lobby group, now struggling to repair its reputation.

Read more here

Bank stocks in focus when US markets open

11:48 , Daniel O’Boyle

Regional bank stocks will be in focus when trading opens on Wall Street today, after concerns over the country’s small and medium-sized lenders reared its head again yesterday.

New York Community Bancorp posted a surprise loss yesterday, because of collapsing commercial property values. The results hit a number of other similar banks across the US.

Shares in New York Community Bancorp closed at $4.20 yesterday, down 22.2%.

Market snapshot as FTSE 100 loses ground

11:11 , Daniel O’Boyle

Check out today’s market snapshot as the FTSE 100 slips back after a steady start to the day.

PZ Cussons slides on dividend cut, FTSE 100 holds firm

10:21 , Graeme Evans

Shares in PZ Cussons, the FTSE 250 company behind brands including Carex and Imperial Leather, today fell 20% after cutting its dividend by 44% due to the impact of Nigeria’s currency devaluation on financial results.

The West Africa country is the Manchester-based firm’s biggest market, representing 35% of sales through brands including Morning Fresh and Premier Cool.

Revenues for the six months to 2 December slid 17.8% to £277.1 million of which £52.9 million was due to the currency’s 51% decline in the period. Adjusted profits fell 24% to £26.1 million.

The turbulence has offset a turnaround for its UK personal care brands following increases in market share, revenue and profitability.

With the naira down another 30% and Nigeria’s inflation rate at a 30-year high of 29%, the company now expects annual operating profits below City forecasts at between £55 million and £60 million. Shares fell 25.8p to 102.2p

The wider FTSE 250 fell 30.07 points to 19,141.27, with emerging markets fund manager Ashmore down 7.6p to 203p despite interim results in line with forecasts.

The FTSE 100 index, which consolidated most of yesterday’s 0.9% rise through a fall of 15.86 points to 7665.15, was led by paper and packaging firm Smurfit Kappa after it announced a 10% dividend rise in annual results.

Profits fell 18% but shares lifted 162p to 3032p as boss Tony Smurfit looked to the current year with “confidence and excitement” after September’s merger with WestRock.

“Better to huddle together for warmth” says analyst on Barratt Redrow

09:56 , Joanna Bourke

Plenty of reaction coming in on Barratt Developments revealing a surprise all-share merger deal for smaller rival Redrow.

Neil Wilson, chief market analyst at Finalto said: “A chill wind has been blowing over the housebuilders – better to huddle together for warmth.”

Russ Mould at AJ Bell said: “Putting the emphasis on how this deal can help deliver the homes the country needs could be seen as an attempt to win over the regulator and politicians.”

Bank of England MPC member: ‘Further evidence’ needed before rate cuts

09:48 , Daniel O’Boyle

Bank of England Monetary Policy Committee member Sarah Breeden said she still needed to see “further evidence” of progress on inflation before the Bank can think about cutting interest rates.

Speaking at the UK Women in Economics Annual Networking Event, she said she had become “less concerned” that interest rates would need to rise again.

Breeden said: “have taken some comfort from developments in other advanced economies, which appear to be a little further ahead than the UK.

“But I need to see further evidence to be confident that the UK economy is progressing as set out in our forecast.”

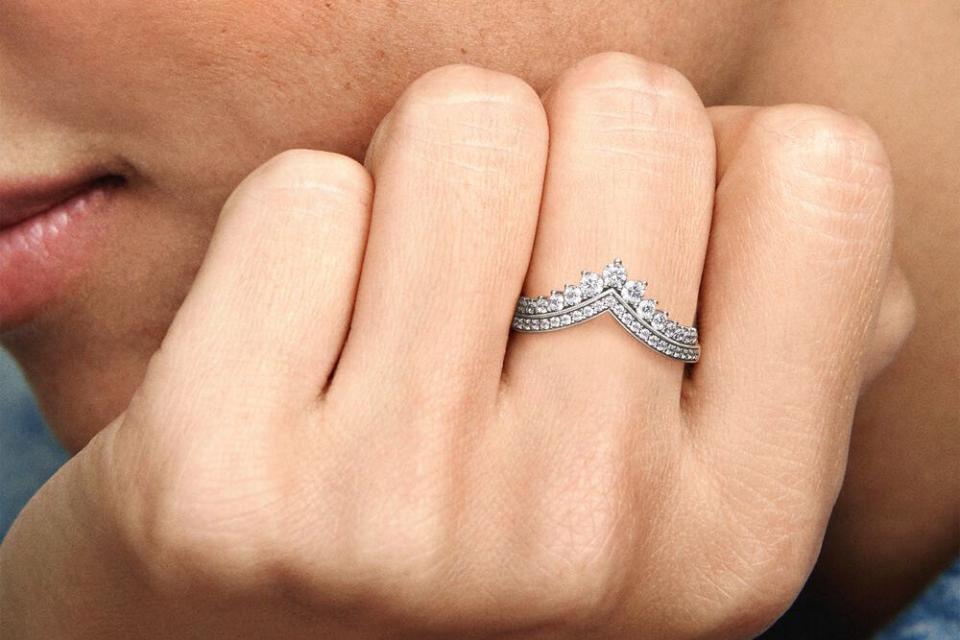

Pandora hails brand strategy as revenue hits record high

09:13 , Daniel O’Boyle

Jeweller Pandora said efforts to “transform the perception” of the business are working, as it reported record revenue in 2023 today.

The Danish business saw revenue hit DKK28.14 billion (£3.2 billion) and profits of DKK7.04 billion in 2023. It said a key reason was a new brand strategy to get customers to view Pandora as a “full jewellery brand”, rather than one known mostly for items like charm bracelets.

Sales in the UK were flat, amid “weak consumer sentiment”.

Frasers buys even more Boohoo shares

08:47 , Daniel O’Boyle

Mike Ashley’s Frasers Group has bought another half-percent of Boohoo, raising its stake in the online fast-fashion retailer to 22.1%.

Frasers has been consistently buying up shares of both Boohoo and Asos in recent months, after shares of the two tumbled in the post-pandemic era.

Boohoo shares are flat at 35.2p today. They’re little changed from June, when Frasers began to build its stake.

Market snapshot: London shares flat

08:42 , Daniel O’Boyle

London shares are little changed from yesterday’s close so far, but Barratt’s shares are down more than 5% as markets digested its Redrow deal and latest results.

Housebuilders rally on Redrow merger, Smurfit shares higher in flat FTSE 100

08:30 , Graeme Evans

Shares in Barratt Developments have fallen 5% or 24.35p to 505.65p after the FTSE 100 housebuilder unveiled plans to buy Redrow in a £2.5 billion deal.

Redrow shares jumped 14% or 85p to 685p in the FTSE 250, while hopes of further consolidation in the sector lifted Bellway by 2% and Crest Nicholson by 7%. Blue-chips Taylor Wimpey Persimmon and Berkeley rose by around 1%.

The FTSE 100 stood 1.27 points lower at 7679.74, with Sainsbury’s down 2% or 6.75p at 268.9p despite plans for a progressive dividend and buybacks in its strategy update.

Paper and packaging firm Smurfit Kappa topped the FTSE 100 risers board, up 136p to 3006p after including a 10% dividend increase in annual results.

The FTSE 250 index improved by 32.30 points to 19,203.64.

However, Carex and Imperial Leather firm PZ Cussons slumped 12% or 16p to 112p after announcing it will cut its dividend by 43% due to the impact of the devaluation of the Nigerian Naira.

Barratt-Redrow merger ‘a seismic shift’ for housebuilders

08:13 , Daniel O’Boyle

Richard Hunter, head of markets at Interactive Investor, says today’s mega-merger of housebuilders Barratt and Redrow comes at a crucial time for the sector, as both companies and their rivals all deal with a ‘toxic cocktail’ of headwinds.

Hunter said: “The move is a seismic shift for the sector, reflecting not only the challenges which housebuilders have more recently faced in terms of the economic backdrop, but also a move to shore up the capabilities of two major players, with the new ‘Barratt Redrow’ company having aggregate revenues of £7.45 billion.

“The rationale for the deal remains in sharp focus, with the toxic cocktail of housebuilder headwinds continuing to wash through.

“Squeezed mortgage affordability and availability resulted in waning customer demand, while broader concerns over general economic growth, consumer confidence and spending have all darkened the picture. At the same time, the removal of the Help to Buy scheme has removed an important plank from first-time buyers and legacy costs for remedial building work continue to come at a significant cost, totalling some £62 million in this period.”

Read more on the deal here

Sainsbury’s eyes £1 billion in cost savings as it plans dozens more store openings

08:05 , Simon Hunt

Sainsbury’s is planning to make as much as £1 billion in cost savings as the supermarket giant hopes to use a tech transformation to become more efficient.

The firm said it plans to open as many as 75 new convenience stores over the next three years as it battles to fend of Asda, which is seeking to claw market share under its own new convenience store rollout.

Under the plans, the number of in-store Argos kiosks are also set to increase.

“Investments in machine learning and intelligent automation will bring greater speed and efficiency to decision-making in areas such as pricing, proposition, range, logistics and sourcing.

“Intelligent technology in areas of the store such as checkouts and replenishment will benefit customers and efficiency, freeing up colleagues to deliver better customer service.”

Sainsbury’s shares fell 1.4% after markets opened.

Barratt Developments in surprise £2.5 billion offer for rival Redrow

07:21 , Joanna Bourke

Britain’s largest housebuilder Barratt Developments has revealed a surprise all-share merger deal for smaller rival Redrow, in a move that values the latter at £2.5 billion.

Under the terms of the combination, recommend by both boards, each Redrow shareholder will get 1.44 new Barratt shares.

The firms said they think the tie-up will “bring together complementary offerings to create an exceptional UK homebuilder in terms of quality, service and sustainability .” More to follow

FTSE 100 set to consolidate gains after late Wall Street turnaround, Asia mixed

07:17 , Graeme Evans

A late rally left Wall Street markets in positive territory, with the S&P 500 index up 0.2% and the Dow Jones Industrial Average 0.3% higher.

The gains came even as Federal Reserve officials continued to play down the chances of an interest rate cut in the coming weeks.

In Asia, the Shanghai Composite built on yesterday’s big rise by adding 0.9% but momentum faded in Hong Kong as the Hang Seng index drifted 0.3% lower after a positive start.

A strong performance in the energy sector meant London’s FTSE 100 index yesterday rose 0.9% to reach its highest level in almost a month.

Elsewhere in Europe, the Dax rose 0.8% to set another record high and the Cac40 improved 0.65%. CMC Markets expects markets to consolidate the gains, with the FTSE 100 forecast to open 17 points higher at 7698.

UK house prices up 1.3% in January

07:05 , Daniel O’Boyle

UK house prices rose by 1.3% in January, according to the country’s biggest mortgage lender Halifax.

It is the fourth consecutive rise, after prices slid as interest rates rose in 2023.

Halifax mortgage director Kim Kinnaird said: “The average house price in January was £291,029, up +1.3% or, in cash terms, £3,924 compared to December 2023.

“This is the fourth consecutive month that house prices have risen and, as a result, the pace of annual growth is now +2.5%, the highest rate since January last year.”

Prices were up 2.5% year-on-year, but in London prices were slightly down on January 2023.

Recap: Yesterday’s top stories

06:40 , Simon Hunt

Good morning from the Standard City desk.

It seems fairly certain that we are in the early stages of what will be a significant jobs shake-out in the City. It has been coming.

There is only so long that employers can justify holding on to six — or seven — figure-earning bankers when business stops coming through the door. The offices and trading floors of many City firms must have been miserable places last year as the IPO and M&A droughts stretched on for long months and the stock market did little better than tread water.

UBS were not putting precise numbers on the scale of their post-Credit Suisse merger job cuts, but you do not need a quantum computer to work out the likely scenario. If you assume an average employee overhead of say $200,000, that $13 billion cost saving target works out at tens of thousands of jobs. There will be other ways of saving money of course, but global banks are like football clubs, a disproportionate percentage of the cost base is simply paying the talent. The two banks had around 11,000 souls in London pre-merger.

Those traditional suit-and-red-braces financial services jobs that have fuelled London’s growth since Big Bang are in long-term decline.

Tech, life sciences and, inevitably, legal and regulatory services, are in the ascendant. The P45s will be flying around EC1, EC2 and E14 this year but the shake-out is unlikely to harm London’s long-term prospects. As ever, it is evolving.

Here’s a summary of our other top stories from yesterday:

[ad_2]